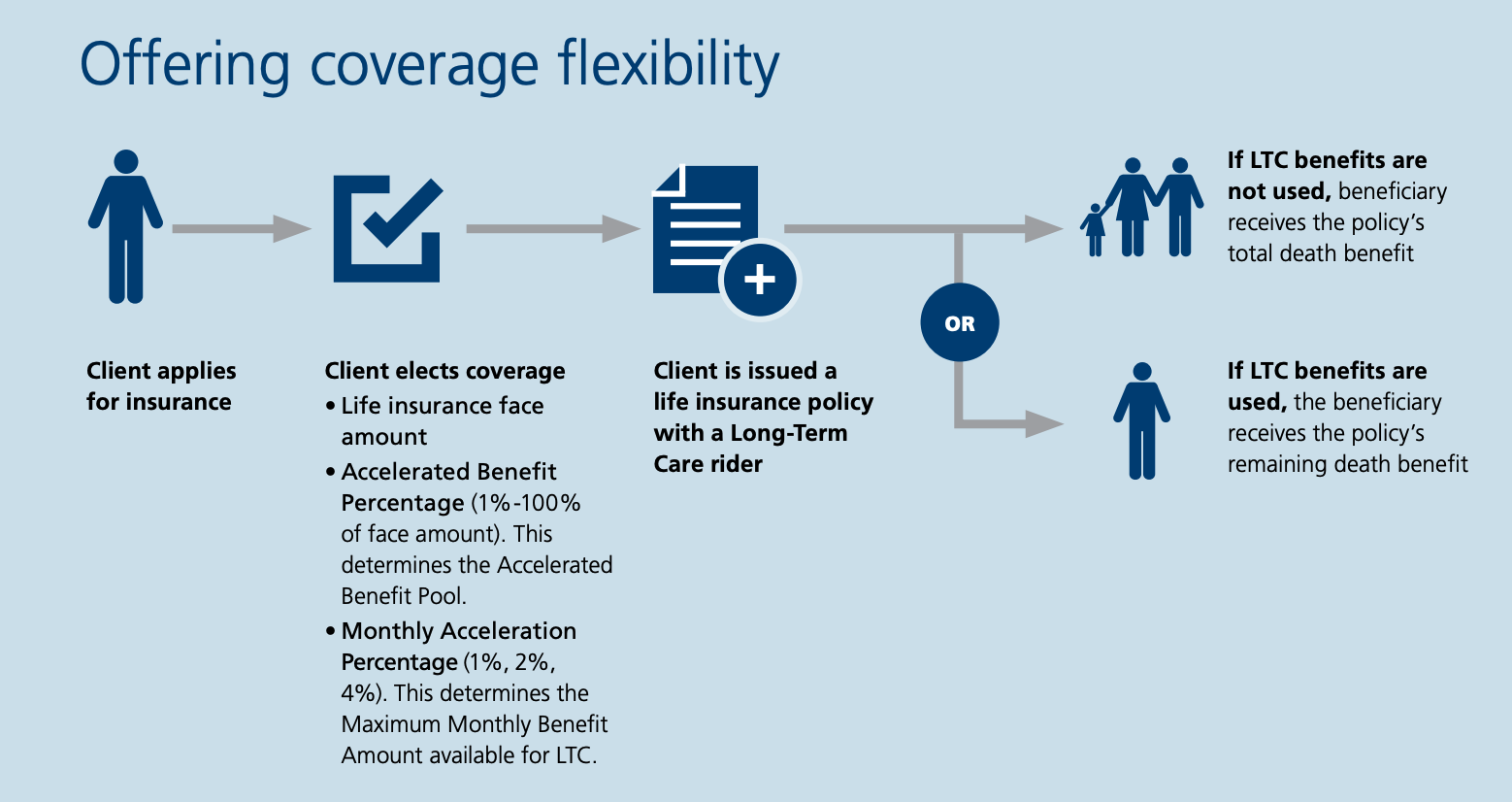

life insurance face amount and death benefit

A permanent life insurance policy has a face value also known as the death benefit. So if you buy a policy with a 500000 face value in most cases your life insurance company will pay out 500000 to your beneficiaries when you die.

Paid Up Life Insurance Explained The Insurance Pro Blog

Simply put the life insurance face value also called the death benefit is the amount that your beneficiary will receive when you die.

. The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person. For example if you buy a 100000 life. The Level Death Benefit Option maintains a constant death benefit amount throughout the life of the insurance policy regardless of accumulated values andor premiums paid by the policy owner.

Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. In all cases life insurance face value is the amount of money given to the beneficiary when the policy. The face amount is the initial amount of money which is stated on the face of the contract that will be paid in a death claim.

In some cases the face amount. They both reflect the amount of money that the insurance company will pay out in. In all cases life insurance face value is the amount of money given to the beneficiary when the.

This is the dollar amount that the policy owners beneficiaries will receive upon the. The face amount or face value of a life insurance policy is the amount of money an insurer will pay out to beneficiaries if the policyholder passes away. This often goes by the name death benefit option A or 1.

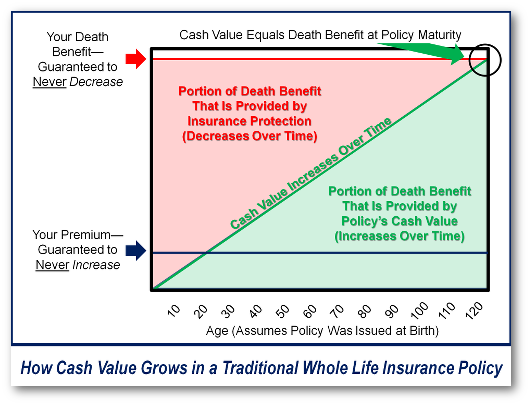

1 Answer At the beginning of the policy the face value and the death benefit are the same. The first death benefit option is a level death benefit. The face amount and thereby the death.

Death benefit insurance for seniors receiving life. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die. It can also be referred to as the death benefit or the face amount of life insurance.

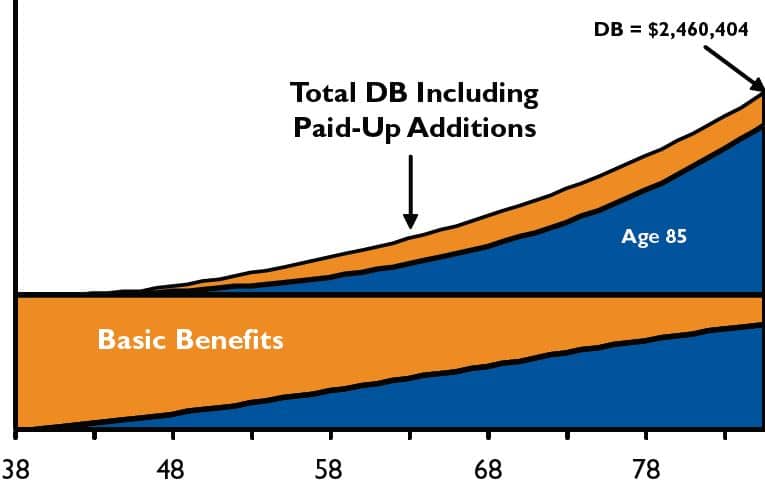

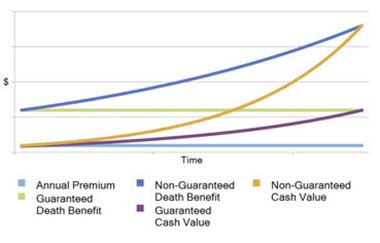

The face amount death benefit remains level and cash value continues to earn interest and mature at age 100 single premium the entire premium is paid in a lump sum at the. Normally the face amount is a round number like. Increasing Death Benefit Conversely if the policy is universal life insurance with an increasing death benefit upon the death of the insured the beneficiary receives 500000 of insurance plus.

It can also be referred to as the death benefit or the face amount of life insurance. Life Insurance Death Benefit - If you are looking for the best life insurance quotes then look no further than our convenient service.

How Whole Life Insurance Works Bank On Yourself

Whole Life S Guaranteed Growth And 4 Ways To Accelerate It For Banking Banking Truths

What Is A Life Insurance Death Benefit Sofi

What Is Universal Life Insurance Unity Financial Solutions Group

A Financial Planner Explains How To Choose A Life Insurance Policy

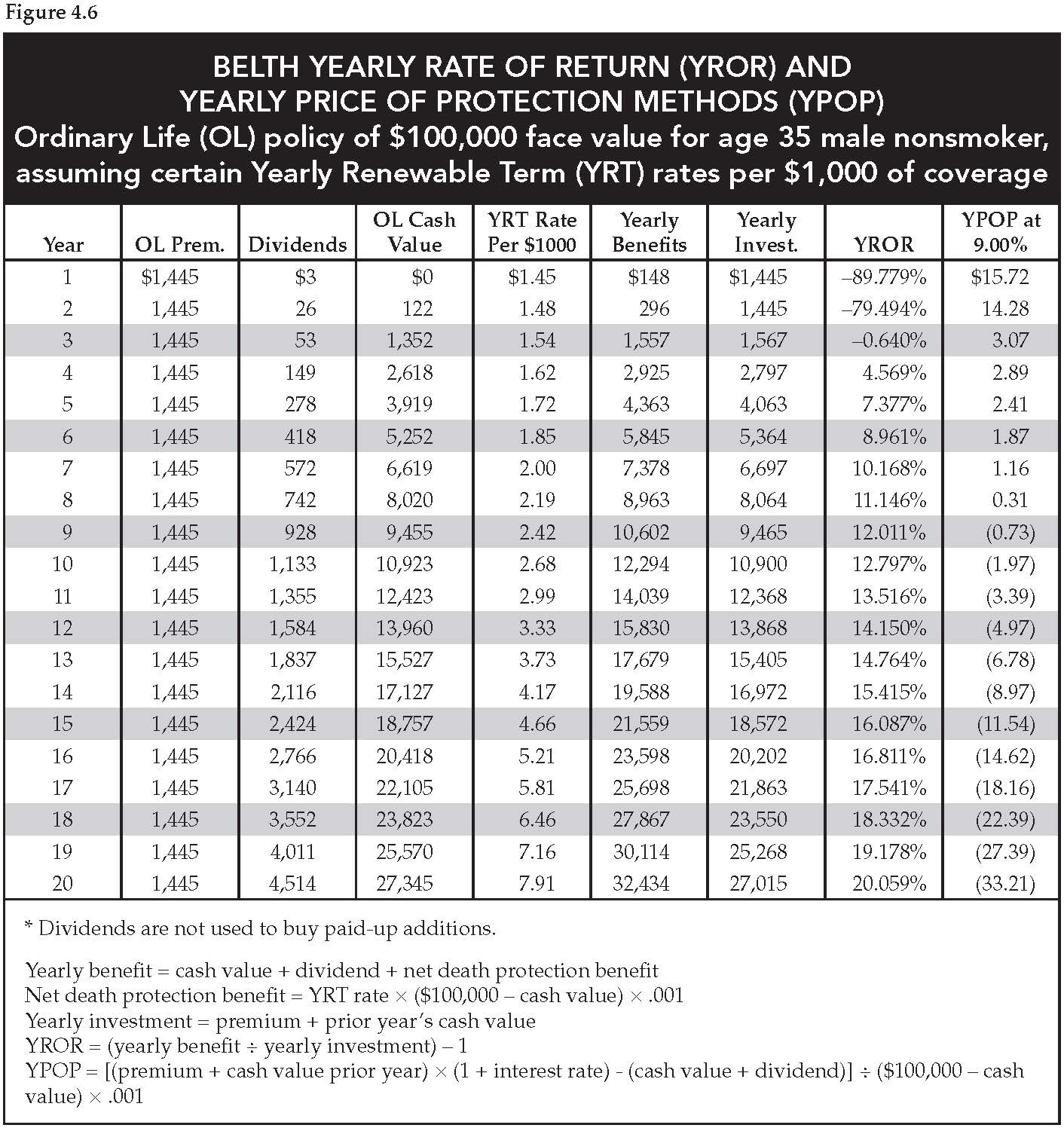

How To Compare Life Insurance Policies Benefitspro

Personal Finance Exam E Face Value Death Benefit Face Amount The Face Value Of A Life Insurance Policy Is The Death Benefit However It S Subject Ppt Download

How To Determine Face Value In Life Insurance Coverage Com

![]()

Variable Universal Life Insurance Vul The Good Bad

How Cash Value Life Insurance Works

Life Insurance Education Catholic Financial Life

What Are Paid Up Additions Pua In Life Insurance

Face Amount Vs Death Benefit Of A Life Insurance The Differences

The Risk Of Surviving To Policy Maturity What Trustees Need To Know Ric Omaha

Face Amount Vs Death Benefit Everything You Need To Know

Whole Life Insurance State Farm

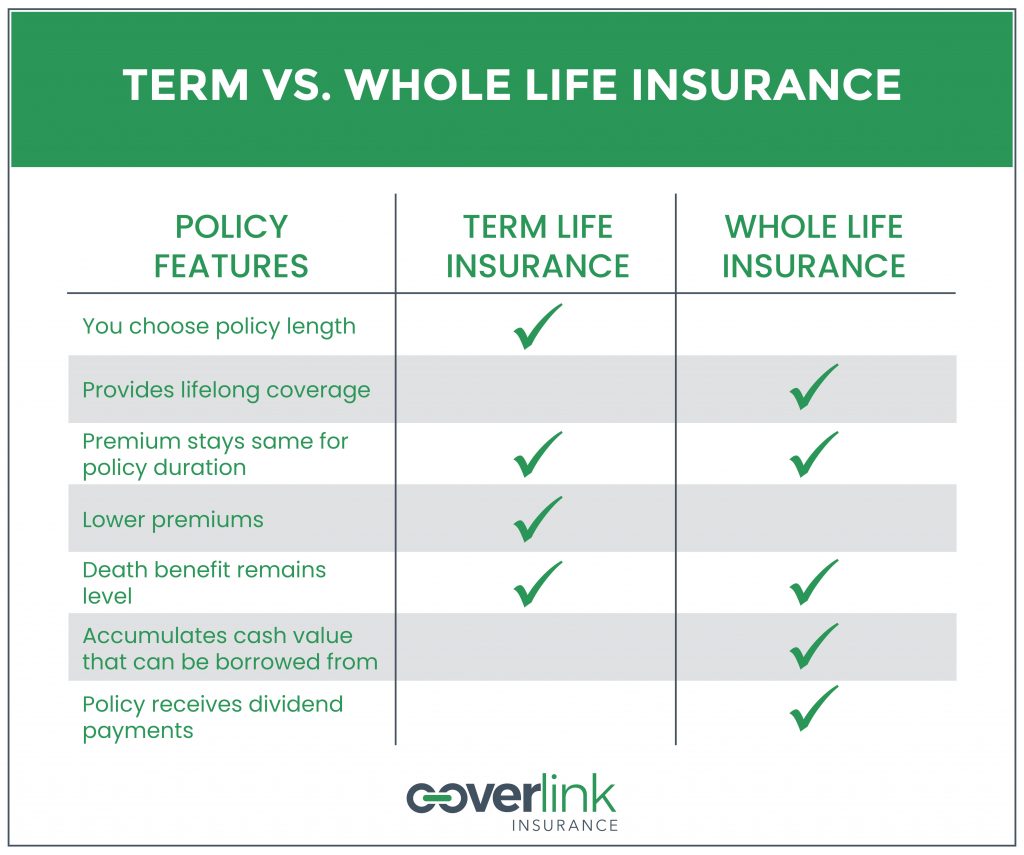

Term Whole Life Or Return Of Premium Life Insurance How To Choose Coverlink Insurance Ohio Insurance Agency

Life Insurance Death Benefit It Is More Nuanced Than You Think